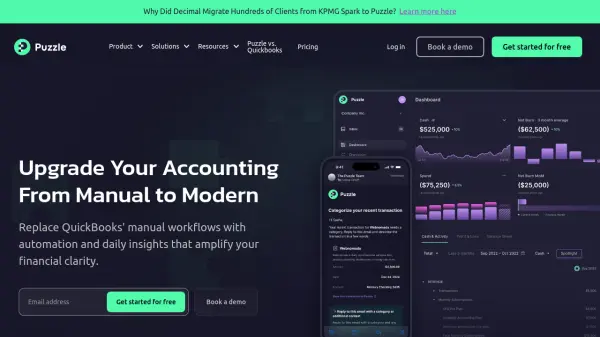

What is Puzzle?

Puzzle offers a modern approach to accounting by automating manual tasks and providing daily financial clarity. It leverages AI to automatically categorize expenses with high accuracy, freeing up valuable time for business owners and accountants. The platform centralizes financial data by integrating with popular tools like Stripe, Brex, Ramp, Rippling, and Gusto, eliminating the need for manual data entry and creating a single source of truth.

Designed for founders and accounting professionals, Puzzle streamlines processes like revenue recognition, deferred revenue, and fixed assets management through embedded accrual accounting policies, moving away from traditional spreadsheets. It continuously monitors financial statements for accuracy, flagging potential errors and anomalies, ensuring reliable financial reporting for decision-making, tax preparation, and fundraising readiness.

Features

- AI Powered Categorization: Automatically categorizes expenses with up to 95% accuracy, learning and improving over time.

- Financial Insights Dashboard: Provides real-time cash flow insights, daily updates, and visual data for better decision-making.

- Centralized Data Integration: Connects with tools like Stripe, Brex, Ramp, Rippling, and Gusto to consolidate financial data.

- Embedded Accrual Accounting Policies: Simplifies revenue recognition, deferred revenue, and fixed assets management without spreadsheets.

- Continuous Accuracy Reviews: Monitors financial statements for errors and anomalies.

- Variance Analysis with Spotlight: Defines thresholds to flag unexpected expenses and provides drill-down capabilities.

- API Access: Offers a powerful API for custom integrations and workflows.

- Real-time Metrics: Tracks key metrics like burn, runway, ARR/MRR.

Use Cases

- Automating bookkeeping tasks for startups and small businesses.

- Gaining real-time financial insights for informed decision-making.

- Streamlining accrual accounting processes.

- Preparing accurate financial statements for taxes and fundraising.

- Centralizing financial data from various sources.

- Improving collaboration between founders and accountants.

- Monitoring business spending and revenue trends.

FAQs

-

Does Puzzle replace my bookkeeper?

No. Puzzle automates 85-95% of repetitive bookkeeping tasks but does not eliminate the need for professional review, especially as finances become more complex. It aims to help bookkeepers focus on higher-value work. -

How does Puzzle keep me tax-ready?

Puzzle provides accurate real-time financial data and generates necessary reports. It also connects users with a network of tax experts if needed. -

Can I migrate my data from QuickBooks?

Yes, Puzzle can import historical financial statements and trial balances from QuickBooks via a read-only login to facilitate the transition. -

How does Puzzle help me understand my business better?

Puzzle provides multiple real-time views of your business, including cash and accrual accounting, key metrics like burn, runway, ARR/MRR, spend analysis, revenue analysis, and variance analysis. -

Do you support multi-currency?

Puzzle does not currently support non-U.S. bank accounts directly. However, it can support transactions converted to USD that flow through connected platforms like Brex, Mercury, or a U.S. bank account.

Related Queries

Helpful for people in the following professions

Puzzle Uptime Monitor

Average Uptime

100%

Average Response Time

445.73 ms

Featured Tools

Join Our Newsletter

Stay updated with the latest AI tools, news, and offers by subscribing to our weekly newsletter.