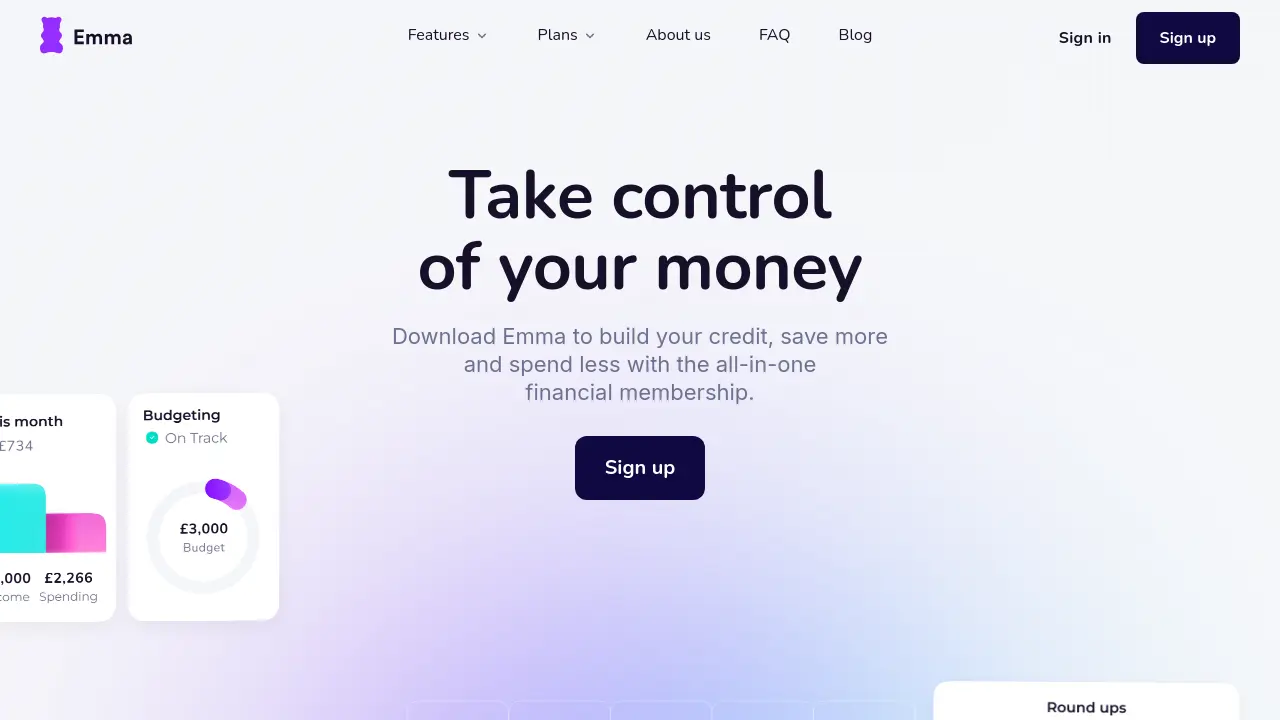

What is emma-app.com?

Emma provides a unified platform for managing personal finances by allowing users to connect all their bank accounts, credit cards, and investment portfolios in one place. The application offers powerful tools to track everyday spending, identify recurring payments like subscriptions, and analyze financial habits through detailed analytics. It facilitates budgeting to help users cut down on unnecessary expenses and stay on top of their financial goals.

Beyond basic tracking and budgeting, Emma enables users to grow their savings, invest in stocks and crypto, and even improve their credit score through features like rent reporting. The app also includes capabilities for sending and receiving payments instantly using payment links or QR codes. Security is emphasized, with FCA regulation, open banking integration, 256-bit TLS encryption, and biometric login options ensuring user data privacy and protection.

Features

- Account Aggregation: Connect all bank accounts, credit cards, and investments in one place.

- Budgeting & Tracking: Analyze spending, track finances, set budgets, and identify wasteful subscriptions.

- Savings Goals: Set and track savings goals.

- Cashback Offers: Access exclusive cashback deals.

- Instant Payments: Send and request money using payment links or QR codes.

- Investment Platform: Invest in stocks and cryptocurrencies starting from £1.

- Rent Reporting: Report rent payments to credit bureaus (Equifax, Experian, TransUnion) to boost credit score.

- Net Worth Tracking: Accurately track net worth over time (Pro feature).

- Custom Categories & Offline Accounts: Advanced budgeting with custom categories and offline account tracking (Pro feature).

- Business Account Connection: Connect business accounts and manage spaces (Ultimate feature).

Use Cases

- Managing personal finances comprehensively.

- Tracking spending across multiple accounts.

- Creating and sticking to budgets.

- Identifying and cancelling unwanted subscriptions.

- Saving money towards specific goals.

- Making peer-to-peer payments easily.

- Starting investing with small amounts.

- Building or improving credit score through rent payments.

- Getting a holistic view of net worth.

- Managing personal and business finances separately (Ultimate plan).

FAQs

-

How does Emma App make money?

Emma generates revenue through optional paid subscriptions (Emma Ultimate, Pro, Plus), fees from users who Invest or Save via the app, and partnerships with affiliates. -

Can I use the Emma App without a bank account?

No, connecting a current, savings, or credit card account is required to use Emma. Ensure your bank is supported before signing up. -

How is my money protected when using Emma?

Emma utilizes various security measures and adheres to regulations specific to its financial products (like saving, investing). The platform is FCA-regulated and uses secure open banking connections. More details are available on their website. -

What platforms and devices does Emma support?

Emma is available on Android, iPhone, iPad, and Web. The Web version is currently in Beta and exclusive to premium subscribers.

Helpful for people in the following professions

emma-app.com Uptime Monitor

Average Uptime

100%

Average Response Time

337.33 ms

Featured Tools

Join Our Newsletter

Stay updated with the latest AI tools, news, and offers by subscribing to our weekly newsletter.