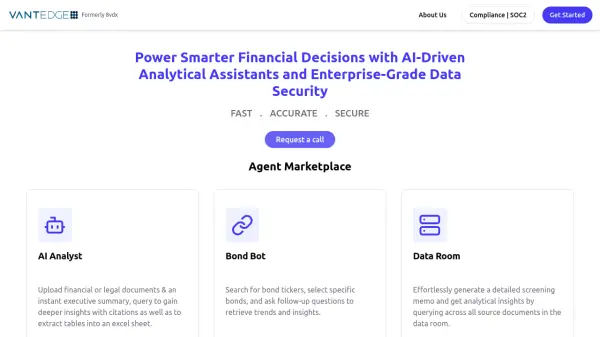

What is VantedgeAI?

VantedgeAI specializes in providing AI-driven analytical assistants designed to empower smarter financial decisions. The platform emphasizes fast, accurate, and secure data processing, underscored by its compliance efforts such as SOC2, catering to professionals in the financial and legal sectors. It combines deep expertise in fixed income investing and AI/ML to deliver tailored AI models that enhance workflows for fund managers and support credit underwriting processes.

The tool offers a suite of specialized assistants to handle various complex tasks. These include capabilities for analyzing financial or legal documents to generate executive summaries and extract tables, searching and retrieving insights on bond tickers, and generating screening memos from data room documents. Additionally, VantedgeAI provides solutions for extracting tables from PDFs and analyzing SEC filings (8-K, 10-Q, 10-K) using natural language queries to produce structured financial data models, with further innovations in portfolio monitoring and automated data modeling on the horizon.

Features

- AI Analyst: Upload financial or legal documents for an instant executive summary, query for deeper insights with citations, and extract tables into Excel.

- Bond Bot: Search for bond tickers, select specific bonds, and ask follow-up questions to retrieve trends and insights.

- Data Room: Effortlessly generate a detailed screening memo and get analytical insights by querying across all source documents in the data room.

- TableXtract AI: Instantly extract tables from any PDF and download them as an Excel file in seconds.

- YC Screening Memos: Access blurbs and screening memos of all launched YC startups (W23 batch onwards).

- 8K, 10Q & 10K Analysis: Analyze SEC filings from public companies using natural language queries, and instantly generate time-series Excel models with structured financial data.

- Portfolio Monitoring: Seamlessly track portfolio companies and generate performance snapshots for Private Credit Investors (Coming Soon).

- AutoModel: Effortlessly extract data from multiple sources into any Excel template (Coming Soon).

Use Cases

- Analyzing financial and legal documents for executive summaries and data extraction.

- Conducting research on bond tickers to identify trends and insights.

- Generating detailed screening memos and deriving analytical insights from data room documents.

- Extracting tabular data from PDF files into downloadable Excel spreadsheets.

- Reviewing screening memos and blurbs of Y Combinator startups.

- Analyzing public company SEC filings (8-K, 10-Q, 10-K) for financial modeling and data retrieval.

- Monitoring investment portfolio companies' performance for private credit investors.

- Automating data extraction from multiple sources into predefined Excel templates.

Related Queries

Helpful for people in the following professions

VantedgeAI Uptime Monitor

Average Uptime

99.86%

Average Response Time

74.83 ms

Featured Tools

Join Our Newsletter

Stay updated with the latest AI tools, news, and offers by subscribing to our weekly newsletter.