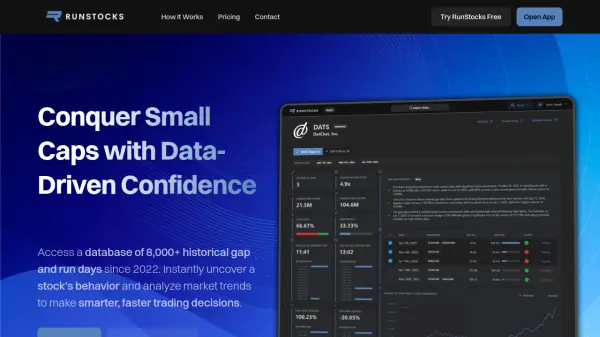

What is RunStocks?

Access an extensive database covering over 8,000 historical gap and run days for small-cap stocks, dating back to 2022. This platform allows traders to instantly analyze a stock's historical behavior and understand market trends, facilitating smarter and faster trading decisions. It provides essential fundamental data such as float size, outstanding shares, insider/institutional ownership, and market cap, which are crucial for assessing a stock's potential strength.

Analyze historical gaps and runs to understand how a specific ticker typically performs after significant pre-market activity. Filter historical data based on current market conditions like pre-market volume or gap percentage for more accurate comparisons. Detailed 1-minute candlestick charts for each gap day enable in-depth analysis of past price action, helping identify patterns, breakout levels, and potential traps, ultimately allowing traders to make decisions backed by historical data rather than guesswork.

Features

- Stock-Specific Character Analysis: Uncover unique trading characteristics and behavioral patterns of individual stocks based on historical data.

- Intraday Price Action: Access detailed 1-minute candlestick data for every recorded event to recognize patterns and refine trade entries/exits.

- Daily Adjustments for Reverse Splits: Automatically adjusts historical stock data daily to ensure accuracy despite reverse splits.

- Comprehensive Historical Data: Analyze an extensive database of small-cap gaps (20%+) and runs (50%+) from 2022 onward with filtering tools.

- Mobile-Optimized: Access key market data seamlessly across devices for on-the-go trading.

- Detailed Performance Metrics: Analyze price movement, volume trends, percentage increase, pre-market high breakouts, peak price action time, and intraday spikes/fades.

- Market Trend Monitoring: Track recent market trends to assess whether gaps are more likely to sell off or continue higher.

- End-Of-Day Calendar of Gaps & Runs: Track all recent gaps and runs easily, useful for identifying second-day plays.

- Fundamental Data Access: Provides critical data like market cap, float, outstanding shares, and ownership percentages.

- AI-Enhanced Insights: Integrates AI summarization for concise company descriptions and key takeaways from historical behavior.

Use Cases

- Analyzing historical performance of small-cap stocks after significant gaps or runs.

- Identifying potential trading opportunities based on historical patterns and current market conditions.

- Understanding a specific stock's typical behavior during high volatility periods.

- Filtering historical data to match today's market setup (volume, gap percentage).

- Reviewing detailed intraday price action from past gap days.

- Monitoring overall market trends for small-cap momentum.

- Accessing fundamental data alongside technical analysis for trading decisions.

- Finding potential second-day trading opportunities.

FAQs

-

What is considered a 'gap' or a 'run' by RunStocks?

RunStocks defines a 'gap' as a stock opening at least 20% higher than its previous close. A 'run' refers to an intraday price movement where a stock gains at least 50% from its opening price. -

How accurate is the historical data provided?

RunStocks ensures data accuracy through daily market updates, automatic adjustments for reverse splits, and cross-checking with multiple data sources. Calculations for gaps, runs, volume, and price action are based on high-quality market data. -

Is RunStocks suitable for traders who are not technically skilled?

Yes, RunStocks features an intuitive interface designed for traders, allowing easy filtering, analysis, and trend identification without requiring coding skills. -

How frequently is the data updated on RunStocks?

Data is updated daily after the market session ends. Historical data is also adjusted daily for any reverse splits to maintain accuracy. -

Does RunStocks cover every stock?

RunStocks primarily focuses on small-cap stocks known for significant price movements, high volatility, large gaps, and explosive runs, tracking thousands of tickers optimized for day traders.

Related Queries

Helpful for people in the following professions

RunStocks Uptime Monitor

Average Uptime

99.72%

Average Response Time

206.27 ms

Featured Tools

Join Our Newsletter

Stay updated with the latest AI tools, news, and offers by subscribing to our weekly newsletter.