What is Parent?

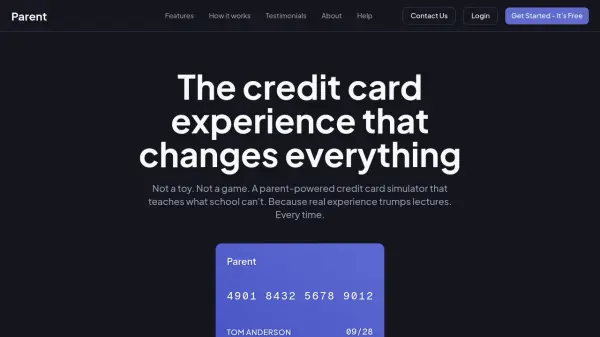

Parent offers a hands-on credit card simulation experience that empowers families to instill lasting financial responsibility in children. Unlike traditional educational approaches, this virtual tool allows parents to grant a credit limit in their child's name, set custom interest rates and repayment terms, and oversee real-world transactions within a family-controlled environment.

Children request purchases and receive cash from their parents, simulate repayment, and experience monthly financial cycles with oversight. The platform transforms abstract concepts like compound interest, credit limits, and budgeting into tangible lessons, fostering responsible habits and meaningful conversations at home.

Features

- Virtual Credit Account: Assign a credit limit and account in the child's name for tangible responsibility.

- Custom Rules and Terms: Set personalized interest rates, repayment schedules, and family-defined standards.

- Real Transaction Simulation: Children make real spending requests, receive actual cash, and manage repayment.

- Monthly Statements: Generate statements with real numbers for transparent family financial discussions.

- Behavioral Impact: Encourages financial conversations, price comparisons, and understanding of consequences.

Use Cases

- Teaching teenagers how credit cards work before they access real credit.

- Introducing children to budgeting, saving, and interest rates in a safe environment.

- Facilitating honest discussions about money between parents and kids.

- Developing positive financial habits through practical, hands-on experience.

- Helping children grasp the real-world impact of purchases and debt.

FAQs

-

What age group is Parent best suited for?

Parent is ideal for children and teenagers who are ready to learn about credit and money management within a family setting. -

How does Parent handle real money transactions?

Children request purchases through the platform; parents provide actual cash and oversee repayment, creating a tangible learning experience. -

Can families customize interest rates and repayment terms?

Yes, parents can set their own interest rates, repayment schedules, and account rules to match their family’s values and lessons.

Related Queries

Helpful for people in the following professions

Featured Tools

Join Our Newsletter

Stay updated with the latest AI tools, news, and offers by subscribing to our weekly newsletter.