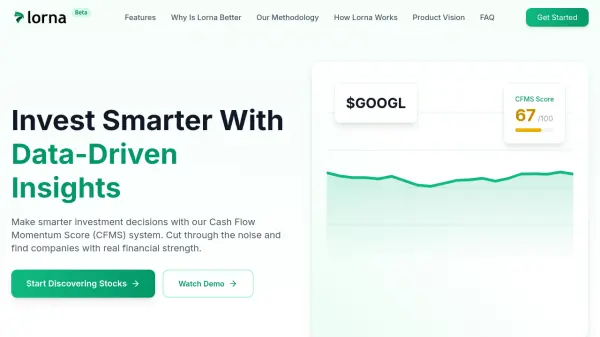

What is Lorna?

Lorna offers an advanced platform designed to assist investors in making more informed decisions through data-driven insights. Utilizing its proprietary Cash Flow Momentum Score (CFMS) system, Lorna evaluates the financial health of publicly traded companies by focusing on their ability to generate and grow cash flow. This approach moves beyond traditional earnings analysis, which can sometimes be misleading, to provide a clearer picture of a company's operational strength and sustainability.

The platform synthesizes comprehensive financial data gathered from official sources like SEC filings and quarterly reports. By analyzing key metrics such as Operating Cash Flow Growth, Cash Flow Efficiency, Return on Invested Capital, EBITDA Margin, and Free Cash Flow Yield, Lorna provides a holistic score reflecting a company's financial performance and growth trajectory. This rigorous, unbiased system aims to remove emotional decision-making and empower users with transparent, actionable investment intelligence.

Features

- Cash Flow Analysis: Evaluate companies based on their ability to generate and grow cash flow over time.

- Comprehensive Scoring: Get a holistic view of a company's financial health with the proprietary Cash Flow Momentum Score (CFMS) system.

- Risk Mitigation: Identify potential red flags and avoid companies with weak financial foundations.

- Actionable Insights: Receive clear, data-driven recommendations to inform investment decisions.

- AI Stock Discovery & CFMS: Leverages artificial intelligence to analyze financial metrics and identify companies with strong cash flow performance.

- Transparent Methodology: Data-driven approach based on SEC filings and official reports, analyzing five key cash flow metrics.

- Broad Market Coverage: Analyzes over 5,000 U.S. and Canadian companies.

- Daily Updates: Provides daily updates on company data and analysis.

Use Cases

- Making smarter investment decisions based on financial strength.

- Evaluating company health beyond traditional earnings metrics.

- Identifying companies with strong cash flow generation and growth potential.

- Screening stocks using AI-powered financial analysis.

- Mitigating investment risks by assessing financial foundations.

- Receiving data-driven recommendations for portfolio adjustments.

- Performing due diligence on potential investments.

- Tracking the financial performance of companies over time.

FAQs

-

What is the Cash Flow Momentum Score (CFMS)?

The CFMS is a proprietary scoring system (0-100) developed by Lorna that evaluates a company's financial health based on its ability to generate and grow cash flow. It analyzes five key metrics: Operating Cash Flow Growth, Cash Flow Efficiency, Return on Invested Capital, EBITDA Margin, and Free Cash Flow Yield, derived from official financial reports. -

How often is the CFMS updated?

The platform provides daily updates, suggesting that the underlying data and potentially the CFMS scores are refreshed daily. -

Is Lorna suitable for beginner investors?

Lorna aims to democratize financial analysis by providing retail investors with professional-grade investment tools and insights at an accessible price point, suggesting it could be suitable for beginners seeking data-driven guidance. -

What markets does the Lorna platform cover?

The platform covers over 5,000 publicly traded companies across the U.S. and Canadian markets. -

How accurate is the CFMS system?

Lorna states a 99.9% accuracy rate associated with its AI Stock Discovery and CFMS analysis feature. The system's calculations are based on data sourced directly from official SEC filings and company reports.

Related Queries

Helpful for people in the following professions

Lorna Uptime Monitor

Average Uptime

85.41%

Average Response Time

3147.9 ms

Featured Tools

Join Our Newsletter

Stay updated with the latest AI tools, news, and offers by subscribing to our weekly newsletter.