What is Illinois Mortgage Calculator?

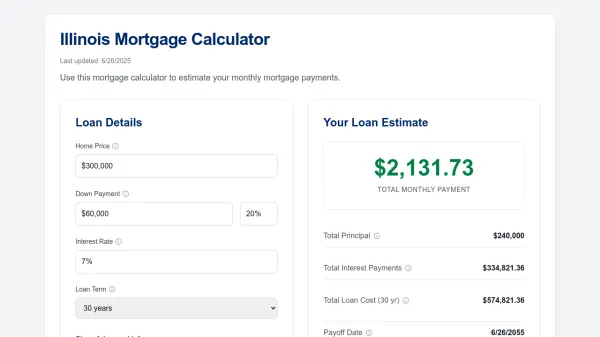

Illinois Mortgage Calculator provides an interactive platform for users to estimate monthly mortgage payments tailored to the Illinois housing market. By entering the home price, down payment, loan term, and interest rate, users receive a detailed breakdown of principal, interest, and total loan costs over time. The tool supports multiple loan terms and accounts for property taxes and insurance typical in Illinois, allowing for comprehensive financial planning.

Additional resources and market insights for Illinois, including first-time homebuyer support and current rate comparisons, empower users to make informed decisions when purchasing real estate. The calculator incorporates advanced features to show detailed payment schedules, estimate payoff dates, and clarify various mortgage types and terminology, serving as a valuable resource for prospective homeowners and real estate professionals alike.

Features

- Payment Estimation: Calculates monthly mortgage payments using key inputs like home price, down payment, interest rate, and loan term.

- Detailed Loan Breakdown: Provides breakdowns of total interest, principal, and overall loan cost over the selected loan term.

- Illinois Market Data: Supplies up-to-date Illinois real estate trends, including market competition and median prices.

- Advanced Info: Highlights payment schedule, payoff date, and additional factors like mortgage insurance and escrow.

- Educational Resources: Links to first-time homebuyer programs and official home buying guides specific to Illinois.

Use Cases

- Prospective homebuyers can estimate their ongoing mortgage payments before purchasing a property in Illinois.

- Real estate agents use the tool to help clients understand financing scenarios and monthly costs.

- First-time buyers analyze the impact of different down payments and interest rates on affordability.

- Financial planners assess mortgage options and costs for clients interested in Illinois real estate.

- Homeowners compare potential refinancing options by visualizing payment differences.

FAQs

-

What costs are included in my mortgage payment?

The monthly mortgage payment typically includes principal, interest, mortgage insurance, and escrow for taxes and homeowner's insurance, depending on your loan terms and lender requirements. -

How does my credit score affect the interest rate?

A higher credit score can help you qualify for lower interest rates, which reduces the total cost of borrowing over the life of the loan. -

Does the calculator work for different loan terms?

Yes, the calculator supports various loan terms, including 30, 20, 15, and 10 years, allowing you to compare payment amounts and overall loan costs for each option. -

Are property taxes and homeowner's insurance included?

Illinois property tax rates and average homeowner's insurance information are incorporated for more accurate monthly estimates, but they may vary based on specific property location and coverage. -

Where can I find first-time homebuyer assistance programs in Illinois?

The calculator provides links to resources such as the Illinois Housing Development Authority (IHDA) and other official guides to support first-time homebuyers.

Helpful for people in the following professions

Illinois Mortgage Calculator Uptime Monitor

Average Uptime

88.61%

Average Response Time

337.27 ms

Featured Tools

Join Our Newsletter

Stay updated with the latest AI tools, news, and offers by subscribing to our weekly newsletter.